API Integration: DirectCashier

Introduction & Document Overview

This is a documentation for the DirectCashier API, a service within the Payment Management Solution set of the GIDX Platform.

This set of documents serves as the integration guide for implementing services of the GIDX Platform API within the operator’s environment. The following pages outline the Customer Insight access points, security, methods, and parameters. As always, please contact us at devteam@tsevo.com any time if further explanation is needed.

An official SDK for the GIDX Platform API is available at GitHub.com and via NuGet (GIDX.SDK) located at the URL below. This SDK can be installed directly into your C# project using the NuGet Package Manager.

SDK LocationGIDX Platform DirectCashier API Method Reference

Below are descriptions of the methods exposed by the GIDX Platform DirectCashier Service. For details about the parameters associated with these methods please see the Class Reference section below.

DirectCashier: Request & Response Parameter Constants

The following parameters are used in every DirectCashier Method Request and Responses. They are labeled within the methods below as Standardized Request Parameters and Standardized Response Parameters.

Making a Request

Each API method has a corresponding Request object used to transport the request parameters as shown below.

Using the Response

Each Response object returned from the method Request will contain properties you can use to determine the status of the methods service.

Use the IsSuccess property along with the ResponseCode and ResponseMessage values to detect if the Request completed without a problem.

Standardized Request Parameters

4QhgWWJxRlqVctrc7SxHEQ

VpGYLoXhSS+WgU9N415IJQ

Fc+k5kRDSAOrh38e21vt0w

m+2XHlcIR0O1C+iBeNzfvA

VV4XTc3tRi6g1EYLOazn0g

xHhSS+WglqVctrc7-t7SEQrc

Standardized Response Parameters

4QhgWWJxRlqVctrc7SxHEQ

v3.0

VpGYLoXhSS+WgU9N415IJQ

xHhSS+WglqVctrc7-t7SEQrc

0

No Errors

DirectCashier: CreateSession

This method should be called to create a new Direct Cashier Session within the GIDX system for payments.

- Request Type:

- HTTP POST: JSON Content Body

- Parameters:

- CreateSessionDirectCashierRequest (object)

- Return Value:

- CreateSessionDirectCashierResponse (object)

CreateSessionDirectCashierRequest

ABC-123

66.249.76.138

1113201405343

1113201405343_1

PAY or PAYOUT

True

MONTHLY

2021-09-07

CustomerRegistrationRequest Object

["NFL-HOU", "NFL-ATL"]

https://yourserver.com/GidxRedirect

https://yourserver.com/GidxCallback

CreateSessionDirectCashierResponse

['DFP-HR','ID-EX']

xHhSS+WglqVctrc7-t7SEQrc

DirectCashier: CompleteSession

This method should be called to finalize and execute a payment that was started with CreateSession.

- Request Type:

- HTTP POST: JSON Content Body

- Parameters:

- CompleteSessionDirectCashierRequest (object)

- Return Value:

- CompleteSessionDirectCashierResponse (object)

CompleteSessionDirectCashierRequest

1113201405343_1

CashierPaymentAmount Object

True

Finix

CompleteSessionDirectCashierResponse

['DFP-HR','ID-EX']

xHhSS+WglqVctrc7-t7SEQrc

1113201405343_1

True

Array of PaymentDetails Objects

If an attempt fails, we will retry daily for 10 days and every attempt will be shown in this list. After 10 days, we will update the parent transaction to PaymentStatusCode 6 (Canceled).

92.3

DirectCashier: CreateSession / Callback

Receiving callbacks from GIDX

When a session expires or a transaction status changes, a callback will be made to the CallbackURL you provided in CreateSession.

The callback will be an HTTP POST with a JSON request body.

An example of the callback JSON is on the right side of this page.

Responding to callbacks

You must respond to the callback correctly, or we will retry the callback up to 5 times over the next 2 hours.

An example of the response JSON is on the right side of this page.

DirectCashierCallback

0

No Errors

xHhSS+WglqVctrc7-t7SEQrc

['DFP-HR','ID-EX']

xHhSS+WglqVctrc7-t7SEQrc

98.5

1113201405343_1

Pending

DirectCashier: PaymentDetail

Once the DirectCashier has been successfully completed the merchant may call this method to retrieve the full transaction details for the payment.

- Request Type:

- HTTP GET: QueryString

- Parameters:

- PaymentDetailRequest (object)

- Return Value:

- PaymentDetailResponse (object)

PaymentDetailRequest

NOTE: The MerchantSessionID supplied in this call must be the same as the one supplied in the initial DirectCashier CreateSession API call.

1113201405343_1

PaymentDetailResponse

1113201405343_1

Array of PaymentDetails Objects

If an attempt fails, we will retry daily for 10 days and every attempt will be shown in this list. After 10 days, we will update the parent transaction to PaymentStatusCode 6 (Canceled).

92.3

[“LL-GEO-US-NV”,“ID-VERIFIED”,“ID-EX”]

DirectCashier: PaymentUpdate

Update the status of a payment. Currently only available to cancel recurring payments.

- Request Type:

- HTTP POST: JSON Content Body

- Parameters:

- PaymentUpdateRequest (object)

- Return Value:

- PaymentUpdateResponse (object)

PaymentUpdateRequest

NOTE: The MerchantSessionID supplied in this call must be the same as the one supplied in the initial DirectCashier CreateSession API call.

1113201405343_1

PaymentUpdateResponse

1113201405343_1

Array of PaymentDetails Objects

DirectCashier: Save PaymentMethod

For adding credit cards, you must use our gidx-js Javascript library, or the Evervault iOS or Android SDK.. See the Credit Cards workflow for more information.

Add or update a payment method. You can call this method from the user's device without supplying your API Key as long as you pass the same MerchantSessionID of a currently active DirectCashier session.

To remove a saved PaymentMethod, pass the Type and Token, along with SavePaymentMethod = false.

- Request Type:

- HTTP POST: JSON Content Body

- Parameters:

- SavePaymentMethodRequest (object)

- Return Value:

- SavePaymentMethodResponse (object)

SavePaymentMethodRequest

NOTE: If calling from the user's device without an API Key, the MerchantSessionID supplied in this call must be the same as the one supplied in the initial DirectCashier CreateSession API call.

True

SavePaymentMethodResponse

DirectCashier: Get PaymentMethods

Get the list of saved payment methods for a customer.

- Request Type:

- HTTP GET: QueryString

- Parameters:

- GetPaymentMethodsRequest (object)

- Return Value:

- GetPaymentMethodsResponse (object)

GetPaymentMethodsRequest

NOTE: MerchantSessionID can be an existing DirectCashier session or you can provide a new one.

ABC-123

GetPaymentMethodsResponse

CustomerIdentity API Methods

Other Identity & Location Methods are located in the CustomerIdentity API located at the endpoint below.

- Endpoint URL:

- https://api.gidx-service.in/v3.0/api/CustomerIdentity

You can view the details of these additional Customer Identity related methods by clicking on the links below.

-

CustomerProfile

This method may be called to get the profile information associated with a verified MerchantCustomerID within the GIDX system. -

CustomerMonitor

This method may be called to get the current compliance status of the customer profile associated with a verified MerchantCustomerID within the GIDX system. -

Location

Location look-up is based on the IP address / Device GPS and the Merchant Settings. Although a MerchantCustomerID is not required it is suggested that any method calls for location associated with a registered customer should have a MerchantCustomerID provided for tracking and compliance audit purposes. The response contains the location details based on the Merchants settings.

Response Object Reference

The Object documented below are returned within the Response of Method Request within the GIDX Platform DirectCashier Services. When applicable an Object may be shared by among other Method Responses as indicated in the listings below.

Objects are always returned in JSON format.

Cashier Object: Action

This object provides information on actions that need to be taken within the merchant application to complete the transaction.

- Usage:

- CompleteSessionDirectCashierResponse (Action)

Type: Open

https://join.iad.actumprocessing.com/Signup/signupLoad.cgi;jsessionid=17E3594FE483C833536AD344A6C1C43A

AWipigSApGaGTWxWxT9THkVKql7K2NfGr5fkOrRwuHiSqpQsSylhU9fD4u1bOIQL4Hj142-6DrqeaWJ2

1KG986478G427540U

https://acs-public.tp.mastercard.com/api/v1/browser_challenges

eyJ0aHJlZURTU2VydmVyVHJhbnNJRCI...

707435d1-998c-4463-9367-c7ecf584e10d

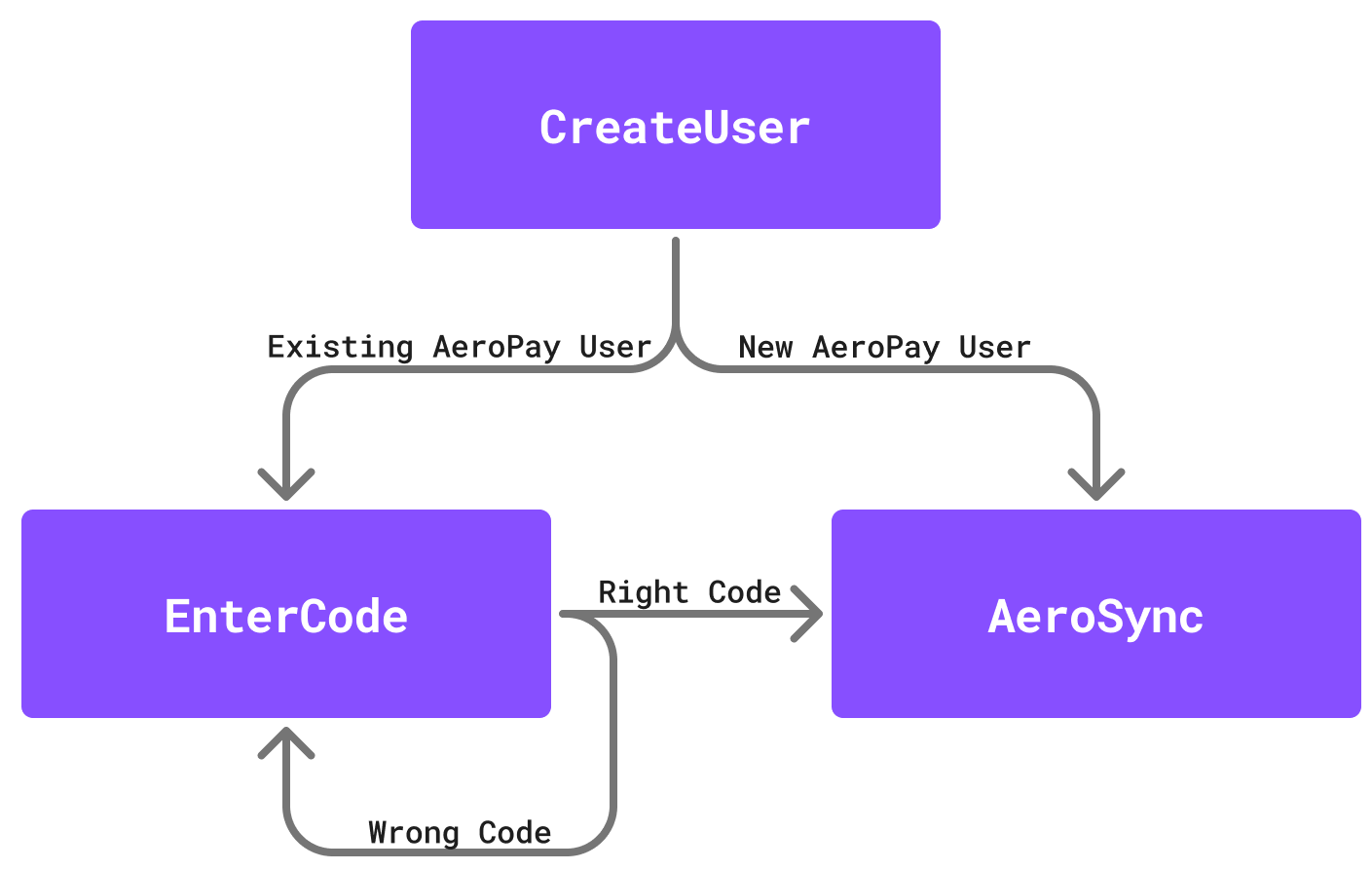

CreateUser | EnterCode | AeroSync

eyJ0...tVwg

b5d77e14-25af-4ebe-8381-7082f5f4c9c3

sandbox | production

Cashier Object: PaymentDetails

PaymentDetails object is currently a work in progress. Subject to change.

This object contains the detailed data of a transaction that has taken place within the DirectCashier CreateSession Request.

- Returned in Response:

- CompleteSession

- PaymentDetail

- Usage:

- The results contained in this object provide your the transaction amount(s), payment method, and other important transaction data parameters and statuses of a DirectCashier Service.

101.08

true

MM/DD/YYYY hh:mm:ss (UTC)

MM/DD/YYYY hh:mm:ss (UTC)

MM/DD/YYYY hh:mm:ss (UTC)

MM/DD/YYYY hh:mm:ss (UTC)

96.2

Approvely

61452378

200

DECLINED

Cashier Object: CashierPaymentAmount

This object contains the payment amount information. For deposits, the user will be charged PaymentAmount + FeeAmount + TaxAmount.

For FeeAmount and TaxAmount, if you don't provide them yourself, we will calculate them based on your settings.

- Usage:

- CreateSessionDirectCashierRequest (PaymentAmounts)

- CompleteSessionDirectCashierResponse (PaymentAmount)

200.00

50.00

New Customer Bonus!

2.00

3.10

True

Cashier Object: PaymentMethod

This object is used to both submit and retrieve payment method information.

- Usage:

- CreateSessionDirectCashierResponse (PaymentMethods)

- CompleteSessionDirectCashierRequest (PaymentMethod)

- SavePaymentMethodRequest (PaymentMethod)

6CADB8D0-6FAE-40DE-937E-03BA3EC9A7A5

Visa (...1111)

Type: CC, ACH, Paypal, ApplePay, GooglePay

John Smith

7131234567

4111111111111111

123

11/2024

Checkout

XYi1pplo2XITHfJdT21SweFz1us=

05

d65e93c3-35ab-41ba-b307-767bfc19eae3

JS: window.screen.colorDepth

JS: -new Date().getTimezoneOffset()

JS: navigator.userAgent

JS: window.nSureSDK.getDeviceId()

Visa

123456789

999999999

Cashier Object: PaymentMethodSettings

A list of these objects is returned by CreateSession to show you what PaymentMethodTypes you have available.

Only Paypal and GooglePay have additional settings (as shown below), but CreateSession will return an object for every PaymentMethodType you have available. For types other than Paypal and GooglePay, the object will just have a single Type property.

- Usage:

- CreateSessionDirectCashierResponse (PaymentMethodSettings)

AWipigSApGaGTWxWxT9THkVKql7K2NfGr5fkOrRwuH...

TEST or PRODUCTION

12345

Cashier Object: BillingAddress

5940 Main St.

Suite A

Las Vegas

77587

Location Object: DeviceGPS

This object should contain the location data derived from the Devices GPS information.

For more information on collecting this data from the Device please click here to see the table below for both iOS and Android.

Apple / iOS

| Device GPS Property | Class | Property | Declaration |

|---|---|---|---|

| Latitude & Longitude | CLLocation | coordinate | CLLocationCoordinate2D |

| latitude | CLLLocationDegrees | ||

| longitude | CLLLocationDegrees | ||

| Radius | CLLocation | horizontalAccuracy | CLLocationAccuracy |

| Altitude | CLLocation | altitude | CLLocationDistance |

| Speed | CLLocation | speed | CLLocationSpeed |

| DateTime | CLLocation | timestamp | NSDate |

Android

| Device GPS Property | Class | Property |

|---|---|---|

| Latitude | Location | getLatitude() |

| Longitude | Location | getLongitude() |

| Radius | Location | getAccuracy() |

| Altitude | Location | getAltitude() |

| Speed | Location | getSpeed() |

| DateTime | Location | getTime() |

| The DateTime in Android is a "ticks" and needs to be converted to the dateTime format MM/DD/YYYY HH:MM:SS.000 | ||

36.169727

-115.141801

600.999

22.9871

45.999

10/01/2013 12:42:15 GMT

Cashier Object: ProcessorToken

The ProcessorToken can be provided in your PaymentMethod request objects if you are using a processor's client-side tokenization.

Evervault

Appendix Library: Code / Status Index

The information documented below provides clarification of the codes used within the GIDX Platform DirectCashier Services.

Appendix Library: ResponseCodes & ResponseMessage

Appendix Library: Session StatusCode

Appendix Library: Session ServiceType

Appendix Library: PaymentStatusCode (TransactionStatusCode)

Payment/TransactionStatusCode Usage

The PaymentStatusCode will be provided when a GIDX service is updating you about a transaction DirectCashier Callback and/or the PaymentDetails method is being called because details/status of the transaction is needed.

In most instances, the PaymentStatus of Pending, Complete, or Failed will be provided, for example...

- Pending:

- The transaction is in a holding state within the GIDX service for a pre-defined reason such as: the customer needs to complete the ID verification process before the transaction is sent to the bank/processors for processing.

- Complete:

- The transaction has been completed by the customer and the bank/processor.

- Failed:

- The processing of the transaction failed at the bank/processor. The details of why the transaction failed are not always provided from the bank/processor in real-time but are updated and viewable in the dashboard as soon as it is provided.

The following PaymentStatus are less common and have specific caveats to their inclusion, for example...

- Ineligible:

- The transaction was not processed due to reasons associated with the bank/processor. This status is applicable to non-gaming related transactions only.

- Reversed:

- The transaction was processed but due to reasons associated with the bank/processor it was subsequently reversed - similar to Ineligible but associated with transactions flagged post processing. This status is applicable to non-gaming related transactions only.

- Canceled:

- The transaction was canceled. Currently applies to the cancellation of recurring transactions.

- Processing:

- The transaction has been sent for processing at the bank/processor but the response has not been provided. This is a very "edge case" scenario that may occur if the PaymentDetails method is called AFTER the GIDX service begins the processing of a transaction at a bank/processor and BEFORE that bank/processor completes the "processing" of the transaction and provides a response of that process. If this PaymentStatus is returned then the common practice should be to wait 10 to 20 seconds and make the PaymentDetails call again (or wait for the Callback).

- Payment Not Found:

- The status of "Payment Not Found" would be provided back if the Transaction ID provided in the PaymentDetails method call could not be found.

Appendix Library: PaymentAmountType

Appendix Library: PaymentMethodType

Appendix Library: PaymentAmountCode

Appendix Library: PayActionCode

The PayActionCode has the following rules for usage...

When the PayActionCode value equals PAYOUT the following CashierPaymentAmount variables are ignored: BonusAmount, BonusDetails, BonusExpirationDateTime.

Appendix Library: RecurringInterval

Appendix Library: ANIResult (Account Name Inquiry)

Appendix Library: AVSResult

Appendix Library: CVVResult

Appendix Library: Data & System Reference

ISO 2 Digit Country Code

ISO 3166-1 is part of the ISO 3166 standard published by the International Organization for Standardization (ISO), and defines codes for the names of countries, dependent territories, and special areas of geographical interest.

http://en.wikipedia.org/wiki/ISO_3166-1

ISO 3166-2:US is the entry for the United States in ISO 3166-2, part of the ISO 3166 standard published by the International Organization for Standardization (ISO), which defines codes for the names of the principal subdivisions (e.g., provinces or states) of all countries coded in ISO 3166-1.

http://en.wikipedia.org/wiki/ISO_3166-2:US

The ISO 4217 code list is used in banking and business globally. In many countries the ISO codes for the more common currencies are so well known publicly that exchange rates published in newspapers or posted in banks use only these to delineate the different currencies, instead of translated currency names or ambiguous currency symbols.

https://en.wikipedia.org/wiki/ISO_4217

For the latest list of Reason Codes and their description please go to the following URL.

View Reason Codes

Payment Method Workflows

Below are descriptions of how each Payment Method is handled by CompleteSession.

ACH

ACH payments are not immediate and will be left in a Pending state at first. In the live environment, you will get a callback when the status is changed. In sandbox, you can manually set the status to Complete in the dashboard and you will receive a callback.

Expected Actions: None

ACH with Actum Authentecheck

Actum Authentecheck allows the user to login to their bank and select their bank account instead of typing the account and routing numbers themselves.

Sending a blank ACH payment method (no AccountNumber and RoutingNumber) will return an Open Action with a URL that you need to open in a new window or tab on the user's device in order to complete the payment.

The selected bank account will be saved for re-use. They will not need to login to their bank on future transactions.

Expected Actions: Open

RedirectURL

Pass a RedirectURL in your CreateSession request if you want the user to be redirected to your site at the end of the Authentecheck process.

The following values will be appended as query string values to the RedirectURL: MerchantSessionID, MerchantTransactionID

In your RedirectURL, you can make an API call to PaymentDetail to get the status.

Test Bank Login

You can use the test bank login below. Additional test data is provided by Plaid here.

- Bank

- Platypus OAuth Bank

- Username

- user_good

- Password

- pass_good

- Account

- Plaid Checking (****0000)

- 2FA Code

- 1234

Sandbox note: The dollar amount show on the first screen of Authentecheck will always be $0 in sandbox. It is just a quirk of the sandbox environment. In production it will show the true amount.

Credit Card

For adding credit cards, you must use our gidx-js Javascript library, or the Evervault iOS or Android SDK..

If you are using our Javascript library, you don't need to call the PaymentMethod API. See the documentation on our Github.

Native Apps

To use the Evervault iOS or Android SDK, you will need a Team ID and App ID to initialize it. These are returned in the CreateSession response, inside the PaymentMethodSettings with Type = CC.

{

"PaymentMethodSettings": [

{

"Type": "CC",

"Tokenizer": {

"TeamID": "team_abcdefg",

"AppID": "app_abcdefg",

"Type": "Evervault"

}

}

]

}

The Evervault encrypted card number and CVV is given to you in their SDK's PaymentCardData object, which you can then forward to us in a PaymentMethod API request like so:

{

"MerchantID": "...",

"MerchantSessionID": "...",

"PaymentMethod":

{

"Type": "CC",

"NameOnAccount": "Nicholas Miller",

"CVV": PaymentCardData.card.cvc,

"ExpirationDate": PaymentCardData.card.expMonth + "/" + PaymentCardData.card.expYear

"ProcessorToken": {

"Processor": "Evervault",

"Token": PaymentCardData.card.number

},

"BillingAddress": {

"AddressLine1": "123 Main St.",

"City": "Houston",

"StateCode": "TX",

"PostalCode": "77002"

}

}

}

Expected Actions: None

Credit Cards with 3DS

To use 3DS for credit card deposits in a web app, use our gidx-js Javascript library.

Expected Actions: None

Approvely Rapid

GambleID is integrated into Approvely Rapid for deposits (credit card, Apple Pay, Google Pay), and payouts (debit card, ACH). You can use our API as normal, with Type = CC and Type = ACH, but there are a couple of additional integration requirements.

3DS

Approvely Rapid requires you to use their 3D Secure (3DS) implementation when processing credit card deposits. Read about their 3DS here.

This involves populating the PaymentMethod.ThreeDS object in your CompleteSession API requests with data about the user's device. To simplify this for you, GambleID has created the gidx-js Javascript library.

With 3DS it is possible that the user's bank could request what is called a 3DS Challenge. This is a URL that needs to be displayed to the user, so they can verify themselves with their bank. For most transactions, there will not be a 3DS Challenge, but your system needs to handle the possibility.

This URL will be returned in the Action property of the CompleteSession API response. To help you display this URL, GambleID has included a function in our gidx-js Javascript library.

Once the user has completed the 3DS Challenge, you must repeat your CompleteSession call, but this time the ThreeDS object just needs the TransactionID property.

Expected Actions: 3DSChallenge

Delayed Transaction Status

When we initiate the transaction with Approvely Rapid, we do not get an immediate response from them. We have to wait for a callback from them to know if the transaction was Complete or Failed.

This means you will receive a Pending status in your CompleteSession API response, and you will need to wait for our callback to know the final status of the transaction. We will send you this callback immediately when we are notified by Approvely Rapid.

Test Credit Cards in Sandbox

You can use the following credit cards in our sandbox to test Approvely Rapid.

- No 3DS Challenge: 2303779999000275

- 3DS Challenge: 2303779999000408

Chargeback Protection (Optional)

If you have opted to use Approvely Rapid's Chargeback Protection, there are 2 things you must add to your integration. Chargeback Protection is not required.

Chargeback Protection Data

You must provide the RapidChargebackProtectionData object in your CompleteSession API request. This object is outlined here. We forward the raw JSON you provide us to Approvely Rapid. Please ask Approvely if you have any questions about this data.

nSure JS SDK

You must include this nSure JS SDK on every page of your website.

<script src="https://sdk.nsureapi.com/sdk.js"> </script>

<script>

window.nSureAsyncInit = function(deviceId) {

window.nSureSDK.init('9JBW2RHC7JNJN8ZQ');

window.nSureSDK.init({

appId: '9JBW2RHC7JNJN8ZQ',

partnerId: "contact Approvely for this"

});

};

</script>

Paypal

Paypal deposits will require you to use Paypal's SDK (JS, iOS, or Android) after you call CompleteSession, using the OrderID returned in the Action.

When any of the SDKs ask for a Client ID, make sure you are using the one associated with the GIDX app within your Paypal developer account.

Expected Actions (Deposits): Paypal

Expected Actions (Payouts): None

JS

First, add a Paypal button to your page.

The JS for the button should look like this:

paypal.Buttons({

createOrder: (data, actions) => {

//Call CompleteSession and return the OrderID that is inside the Paypal Action

return getCompleteSessionResponse()

.then(function (response) {

return response.Action.OrderID;

});

},

onApprove: (data, actions) => {

//There is no need to manually capture the order here as shown in Paypal's own sample.

//GIDX will be notified when the order is approved and automatically capture it.

//Here, you can call PaymentDetail to get the latest transaction status and inform the user.

}

}).render('#paypal-button-container');

iOS

First, add the Native Checkout SDK to your iOS app.

Add a Paypal button, or programmatically start the SDK.

Follow the instructions in their Server-Side Integration section to set CreateOrder and OnApprove callbacks like this:

Checkout.setCreateOrderCallback { createOrderAction in

//Call CompleteSession and use the OrderID that is inside the Paypal Action

createOrderActions.set(orderID)

}

Checkout.setOnApproveCallback { approval in

//There is no need to manually capture the order here as shown in Paypal's own sample.

//GIDX will be notified when the order is approved and automatically capture it.

//Here, you can call PaymentDetail to get the latest transaction status and inform the user.

}

Android

First, add the Native Checkout SDK to your Android app.

Add a Paypal button, or programmatically start the SDK.

Follow the instructions in their Server-Side Integration section to set CreateOrder and OnApprove actions like this:

paymentButton.setup(

new CreateOrder() {

@Override

public void create(@NotNull CreateOrderActions createOrderActions) {

//Call CompleteSession and use the OrderID that is inside the Paypal Action

String orderID;

createOrderActions.set(orderID);

}

}

);

paymentButton.setup(

new OnApprove() {

@Override

public void onApprove(@NotNull Approval approval) {

//There is no need to manually capture the order here as shown in Paypal's own sample.

//GIDX will be notified when the order is approved and automatically capture it.

//Here, you can call PaymentDetail to get the latest transaction status and inform the user.

}

}

);

Apple Pay

Apple Pay deposits will require you to use Apple's SDK (JS, or iOS) after you call CreateSession. You will then serialize the Payment object returned by Apple to a JSON string, and pass it to CompleteSession.

Expected Actions: None

Google Pay

Google Pay deposits will require you to use Google's SDK (JS, or Android) after you call CreateSession. You will then serialize the PaymentData object returned by Google to a JSON string, and pass it to CompleteSession.

Expected Actions: None

Checkout.com

We offer a few of Checkout.com's features that require additional integration on your part.

3DS

You can selectively enable Checkout.com's integrated 3DS feature by passing PaymentMethod.ThreeDS.Enabled = true in your CompleteSession API request. This will return a URL in the Action object of the CompleteSession API response that you can send the user to.

First, you must pass a RedirectURL in your CreateSession request. The user will be redirected to this URL after completing the 3DS. When we redirect to this URL, we will add the following query string values: MerchantSessionID, MerchantTransactionID. The redirect will happen whether the user's 3DS is successful or not. You can make a PaymentDetail API call, or wait for the callback, to find out the final status.

Second, set PaymentMethod.ThreeDS.Enabled in your CompleteSession request.

Finally, look in the Action object of the CompleteSession API response. Redirect the user to the URL provided.

Expected Actions: Open

Account Name Inquiry

In your CompleteSession API request, set PaymentMethod.ANI.Enabled to perform an Account Name Inquiry at Checkout.com

Device Session ID

If you integrate into Checkout.com's Risk SDK, you can pass us their Device Session ID in the ProcessorSessionID property of your CompleteSession API request.

{

ProcessorSessionID: await risk.publishRiskData()

}

Finix

Processor Session ID

Finix requires that you use their Fraud Detection Javascript library. Use our gidx-js Javascript library to get the ProcessorSessionID you must provide in either your CreateSession or CompleteSession requests.

AeroPay

Our integration with AeroPay allows users to connect their bank account using AeroPay's AeroSync widget and perform instant guaranteed deposits and payouts.

How it works

Similar to how Evervault is implemented as a "tokenizer" for credit cards, AeroPay is implemented as a "tokenizer" for bank accounts. We return the information you need to load their AeroSync widget. The connected bank accounts get saved as a PaymentMethod (Type = ACH), and payments are processed as normal.

Additionally, before connecting a bank account, the customer must go through the AeroPay user creation flow. This process is outlined below.

Tokenizer and Action objects

The current AeroPay state of the user is provided in the Tokenizer property of the ACH PaymentMethodSettings object returned in the CreateSession API response. Also, as you make PaymentMethod API calls during the session, the updated state is returned in the Action property.

{

Type: "AeroPay",

Step: "CreateUser | EnterCode | AeroSync",

Environment: "sandbox | production", //Used by AeroSync widget

AeroSyncToken: "string", //Used by AeroSync widget

ConsumerID: "string", //Used by AeroSync widget

Message: "string", //Any message returned from the AeroPay API that can be displayed to the user

//After successfully entering their OTP code, we will return the list of bank accounts already saved to their AeroPay account.

BankAccounts: [

{

"Type": "ACH",

"AccountNumber": "******6898",

"BankName": "Aerosync Bank (MFA)",

"DisplayName": "x6898",

"Token": "6650aa97-cc87-42ff-a671-82ca47412489",

"NameOnAccount": "John Smith",

"ProcessorToken": {

"Processor": "AeroPay",

"Token": "1137102"

}

}

]

}

Steps Overview

As users go through the AeroPay process, they move through different "steps". See the image below. Users progress through the steps using a series of PaymentMethod API calls. The API calls needed to move from each step to the next are outlined below.

Step: CreateUser

Before connecting a bank account, we must create the user at AeroPay. When creating an AeroPay user, there are 2 possible scenarios:

- New User

- The user has never used AeroPay before at any other merchant. Next step: AeroSync

- Existing User

- The user has used AeroPay before at another merchant. Next step: EnterCode

Make the following PaymentMethod API call to create the AeroPay user and move to the next step.

{

"PaymentMethod": {

"Type": "ACH",

"PhoneNumber": "713-555-0000", //The number that the OTP code will be sent to.

"ProcessorToken": {

"Processor": "AeroPay"

}

}

}In sandbox, if you want to reset the user's state back to the CreateUser step, send the following PaymentMethod API call.

{

"PaymentMethod": {

"Type": "ACH",

"ProcessorToken": {

"Processor": "AeroPay",

"ResetUser": true

}

}

}Step: EnterCode

After calling the PaymentMethod API above in the CreateUser step, the user will be emailed or texted a OTP code to confirm their account.

Make the following PaymentMethod API call to pass us the OTP code.

{

"PaymentMethod": {

"Type": "ACH",

"ProcessorToken": {

"Processor": "AeroPay",

"AeroPayCode": "123456"

}

}

}If the user needs the code to be resent, you can make the same API call you made in the CreateUser step.

If the user enters the wrong code, the same EnterCode step will be returned again.

Step: AeroSync

Once a user is created at AeroPay, they will stay in the AeroSync step. Implement the AeroSync widget for your environment using the AeroSyncToken, ConsumerID and Environment we returned.

In the onSuccess event triggered by the AeroSync widget, you will serialize the payload they provide into a JSON string and pass it to us using the PaymentMethod API.

{

"PaymentMethod": {

"Type": "ACH",

"ProcessorToken": {

"Processor": "AeroPay",

"Token": "{\"user_id\":\"b5ea1b5154b348dba793adb27c156e38\",\"user_password\":\"a490a8a76c0b47c2ad8e6043f59fcdc1\",\"ClientName\":\"Aeropay Sandbox\",\"FILoginAcctId\":113786059}"

}

}

}